WisdomTree Europe: Is credit growth picking up in China

Is Credit Growth Picking Up in China?

One of the key takeaways from the Federal Reserve’s (Fed) decision not to raise interest rates in September was its newfound concern for “global economic and financial developments.”[1] The Fed indicated that in addition to monitoring U.S. employment and U.S. inflation, it would also monitor the economic and financial climate overseas, which we translate as “tribulations emanating from China that can ripple through emerging markets.” Chairman Janet Yellen’s September press conference raises the question, “Will the Fed have any more visibility into what is happening in China by the October or December meetings?”

The Chinese stock market is easy enough to monitor. With margin lending contracting, the Shanghai stock exchange stabilized in recent weeks, treading water around the 3,000 level after declining 40% from its June highs. But getting a precise pulse on what’s happening inside China’s economy is harder. The government reports that Chinese gross domestic product (GDP) growth has fallen to 7%, after averaging 10% per year for the past 20 years. Other market indicators are more troubling.

China’s Caixin Manufacturing Purchasing Managers’ Index (PMI) stayed below a reading of 50 for the seventh consecutive month in September, falling to 47.2, a reminder that China’s immense manufacturing sector is contracting. Imports into and exports out of China are both down compared to a year ago. The approximate 25% decline in the price of copper in the last year is one indication that Chinese industrial and construction demand is waning, as China accounts for about 40% of global copper demand.

Chinese demand for certain imported agricultural commodities is also down. For example, the world’s most populous nation imported 25% less sugar in August than it did a year ago, pushing down the price of sugar to levels not seen since the financial crisis in 2008. All of this is impacting companies and countries that depend on China for their exports, particularly those in emerging markets.

The steady slide in the currencies of many commodity-exporting nations has added a new measure of potential instability into the global financial system. The most recent International Monetary Fund (IMF) update on emerging market borrowing reminds us that outstanding corporate debt, denominated in dollars, has risen in the developing world from $4 trillion in 2004 to more than $18 trillion today.[2] This is, in our view, one of the reasons the IMF—the world’s lender of last resort—has cautioned the Fed not to raise interest rates in the past few months. Emerging market debt in dollars— and with it, the potential for further dollar appreciation against foreign currencies—is yet another risk the Fed may need to be mindful of as it considers raising interest rates.

So a key question for U.S. investors is how well the Chinese navigate their current transition from an investment-led economy to one in which consumer spending plays a greater role in future growth. One window into that transition is credit growth, specifically lending activity that fuels household consumption. A look inside China’s latest total social financing (TSF) data presents a useful summary of credit formation in the world’s second largest economy. From the detailed breakdown presented below, we make the following observations.

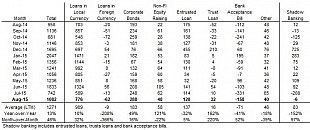

China Total Social Financing Summary (Flow Data, Renminbi (RMB), Billions)

Source: WisdomTree Europe, PBOC, Bloomberg. Data as at 31/08/15.

Total credit formation in August 2015 was 1.08 trillion RMB, which was up 13% on a year-over-year basis, and 50% higher than the month earlier. Although still lower than its average over the last 12 months (LTM), the overall growth trend seemed to be picking up. Bank lending to the real economy contributed the most to the credit growth, reaching 776 billion RMB. The 10% annual growth in these “loans in local currency” (including the loans to nonbank financial institutions) signals that new bank lending inside the country has been holding up relatively well, despite the broader slowdown elsewhere in the Chinese economy.

Credit growth has been contracting in the shadow banking channel, which includes entrusted loan, trust loans and Bank acceptance bill. As a whole, lending in this segment decreased 6 billion RMB in August after a more pronounced decrease of 208 billion RMB in July. In other words, while the growth in overall credit formation has slowed in the last 12 months, traditional bank lending remains healthy in the face of a contraction in new credit within the shadow banking system.

Net-net, this is likely a positive for the transparency and regulation of the Chinese banking system. Corporate bond issuance posted another strong reading of 288 billion RMB in August. That represented 49% growth versus the same time last year. The issuance of corporate bonds by Chinese companies is also an encouraging signal. It suggests a better mix of credit formation may be developing in China, which may help to reduce the concentration risk of the overall credit system.

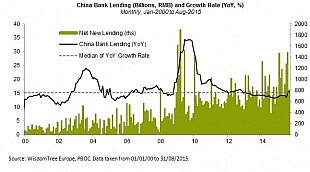

China Bank Lending (Billions, RMB) and Growth Rate (YoY, %)

Monthly, Jan-2000 to Aug-2015

Source: WisdomTree Europe, PBOC. Data taken from 01/01/00 to 31/08/2015.

Conclusion

At a time when capital has been flowing out of China in search of havens outside the country, it is important that private sector credit growth continues to expand inside China, and that it continues to flow to consumers and businesses. The most recent figures signal that net new Chinese bank lending has been inching up in recent months. Continued credit expansion to households will be an important metric to monitor, as will overall consumer spending as a percentage of Chinese GDP. This transition is likely to take several years. But in the short term, a bottoming process to the Chinese stock market and renewed credit growth in China are two important data inputs for monitoring the stabilization of “global financial conditions.”

Investors sharing this sentiment may consider the following UCITS ETF:

- WisdomTree Emerging Asia Equity Income UCITS ETF (DEMA)

- WisdomTree Emerging Markets Equity Income UCITS ETF (DEM)

- WisdomTree Emerging Markets SmallCap Dividend UCITS ETF (DGSE)

All data is sourced from WisdomTree Europe and Bloomberg, unless otherwise stated. Data as at 05/10/2015.

Disclaimer

WisdomTree Europe Ltd is an appointed representative of Mirabella Financial Services LLP which is authorised and regulated by the Financial Conduct Authority.

The value of an investment in ETPs may go down as well as up and past performance is not a reliable indicator of future performance. An investment in ETPs is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

ETPs offering daily leveraged or daily short exposures (“Leveraged ETPs”) are products which feature specific risks that prospective investors should understand before investing in them. Higher volatility of the underlying indices and holding periods longer than a day may have an adverse impact on the performance of Leveraged ETPs. As such, Leveraged ETPs are intended for financially sophisticated investors who wish to take a short term view on the underlying indices. As a consequence, WisdomTree Europe Ltd is not promoting or marketing BOOST ETPs to Retail Clients. Investors should refer to the section entitled “Risk Factors” and “Economic Overview of the ETP Securities” in the Prospectus for further details of these and other risks associated with an investment in Leveraged ETPs and consult their financial advisors as needed. Within the United Kingdom, this document is only made available to professional clients and eligible counterparties as defined by the FCA. Under no circumstances should this document be forwarded to anyone in the United Kingdom who is not a professional client or eligible counterparty as defined by the FCA. This marketing information is intended for professional clients & sophisticated investors (as defined in the glossary of the FCA Handbook) only.

This marketing information is derived from information generally available to the public from sources believed to be reliable although WisdomTree Europe Ltd does not warrant the accuracy or completeness of such information. All registered trademarks referred to herein have been licensed for use. None of the products discussed above are sponsored, endorsed, sold or promoted by any registered trademark owner and such owners make no representation or warranty regarding the advisability on dealing in any of the ETPs.

[1] FOMC statement, 17/09/2015

[2] “Corporate Leverage in Emerging Markets – A Concern?” – International Monetary Fund, 10/15