Dispelling the myth: ETF Traded Volume Does Not Equal ETF Liquidity

HEDJ LN: A Liquidity Case Study

It is the greatest myth in the ETF industry that trading volume equals liquidity when it comes to exchanged traded funds (ETFs). It is important for investors to understand:

- Exchange volume and assets under management (AUM) rarely has an impact on the potential underlying liquidity of an ETF

- ETF liquidity can be sourced from both the primary market (creation / redemption), the secondary market (stock exchange) and derivative markets

- Investors are narrowing their horizons by flocking to the most traded products and not considering new products with lower traded volume

- Traded volume is traded volume, not liquidity!

How investors use ETFs

Different types of ETFs can serve different purposes depending on the exposure they provide. Some ETFs are used primarily for hedging and intraday portfolio trading. These ETFs typically track major world benchmark indexes, and they can trade millions of shares per day. ETFs can also be structured more as investment vehicles and don’t typically have very high average daily trading volumes. Investors make investments into these products, hold their positions and eventually unwind the investment months or years down the road. While all ETFs can be held for prolonged periods or equally traded intraday, some ETFs experience more secondary market trading than others. At WisdomTree, we structure all our ETFs with liquidity screens to help provide sufficient implied liquidity (underlying liquidity), so even if the ETF has a low average daily volume in ETF terms, that does not mean the ETF is illiquid.

When an ETF is launched, it is typically launched at a low asset level. Once the ETF goes live, it has no trading history and a low AUM level. This however does not affect the potential underlying liquidity that inherently exists in the ETF. ETF liquidity can be sourced very efficiently through its underlying securities, and large trades can be done with ease for investors. Depending on the underlying basket, trades can often be executed efficiently which are greater than the average daily volume of the ETF and larger than the current assets under management of the ETF. This is because the ETF market makers or authorised participants (APs) are sourcing the liquidity of the underlying basket and extrapolating that into ETF liquidity for the investor.

What are APs?

APs have the right to create and redeem to demand. APSs buy and sell ETFs to demand and often in advance of a creation or redemption. By hedging in the underlying markets they can price ETFs dynamically to satisfy this demand and flatten the hedge by creating new units at the end of the day. This occurs many thousands of times a day in the ETF industry and there are many global leading trading firms with expertise in ETF trading that facilitate this for clients.

How it works in the real world

Even though the above is true, investors can still be sceptical that a large trade/investment can be done efficiently on an ETF with low daily volume and a low AUM level. This is because ETFs trade like equities so historically, the common approach to buying equities is to use the daily average volume as a threshold for making an investment that doesn’t impact the underlying prices. This thinking has been erroneously applied to ETFs. However, it should only be applied to the underlying equities or assets in the ETF basket which represent the index or benchmark being tracked. This measures true ‘implied liquidity’.

On Thursday, 10 December 2015, we saw a great real time example of what is possible in ETFs with deep underlying baskets.

Prior to this large trade, HEDJ LN had approximately $79.79m[1] in assets under management.

WisdomTree Europe Equity UCITs ETF – USD Hedged

Ticker: HEDJ LN

Approx AUM on 10 December 2015: $81.6m[2]

30 Day ADV[3]: 20,645 shares (approx. $318,000) per day

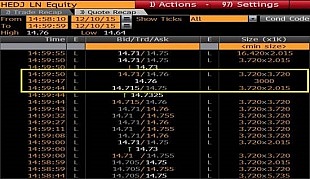

You can see below at 14:59:47 the exact print of 3 million shares of HEDJ LN (approx. $44.25M) in one single block trade. The entire block trade occurred one penny above the quoted spread and did not move the market of the ETF or the underlying stocks in the basket in the process. This is the power of the ETF structure and ETF liquidity. The AP was able to source the liquidity in the underlying securities and provide a single block ETF price to the client in the entire size they wanted to trade. The AP sold the ETFs before they owned them because they could hedge real time. If the daily traded volume of an ETF truly represented liquidity then this should have had a significant impact on the ETF’s pricing, but it did not.

Source: Bloomberg

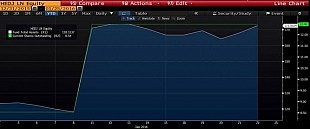

On the below chart, you can see that following the large print, we saw a creation of new shares (increase in shares outstanding), which ultimately grows the assets under management of the ETF. This is a great example of the true untapped liquidity the exists in the ETF structure. It also clearly shows how ETFs can be bought or sold in significant numbers before the ETFs actually exist.

Source: Bloomberg

ETFs v stocks

A low volume stock may be perceived by the market as an illiquid stock because market participants cannot create new shares of stocks based on demand they have only the shares available to trade unless the company has a new issue. However, ETFs operate differently. ETFs are open-ended vehicles and if the broker dealer community has increased demand of an ETF, they can create new shares on a daily basis to satisfy this new demand. That is a key differentiator between ETFs, close end funds and single stocks. Investors also get concerned that it’s easy to get in but hard to get out. The creation and redemption process are the same but in reverse so there should be no issues with selling.

Investors also need to recognise that the ETF’s average daily volume and on-exchange volume is not indicative of the true liquidity that exists in an ETF. There are many very sophisticated dealing desks and market makers in the marketplace that help clients’ source liquidity in ETFs on a daily basis. This means that you can always buy or sell an ETF even if there is no natural investor demand or supply.

ETF Implied Liquidity

To help investors quantify the potential underlying liquidity in an ETF, 3rd party data providers have recently been publishing an ETF implied liquidity figures based on the principles outlined above. Below, Bloomberg outlines that when looking at the underlying securities, you can trade approx. $213m USD of HEDJ LN without having a price impact on the underlying securities (not the ETF). While this is an estimation, it is helping investor quantify potentially how much they can trade of an ETF on a daily basis when looking through the ETF at the liquidity of the underlying securities. This is a third party validation of the structure.

Source: Bloomberg

In times of volatility, how do ETFs hold up?

During January 2016, volatility began to spike as various macro events began to shake the equity markets worldwide. Below you can see that during this increased volatility, an investor was still able to invest approximately $54m in the WisdomTree Europe Equity – USD Hedged (HEDJ LN). New shares were created between 8 January to 11 January 2016, leading to an increase in total assets in the product. At WisdomTree, we use liquidity screens when constructing our index methodologies and as well as keeping a close eye on liquidity when managing our ETFs so that our products will be well positioned during times of increased volatility.

Investors have access to key equity markets in real time and can watch the price of the ETF change and evolve intra-day, compared to most other structures that have NAV style executions (investors are subject to the end of day execution price with no transparency. The intra-day pricing of ETFs gives the execution power to the ETF investors.

However, it is important to note that an ETF is an open-ended vehicle and is representative of the underlying securities and is priced on a daily basis based on the liquidity and access to the underlying securities. If the spreads in the underlying securities widen out, then it is likely that the ETF spreads will widen out.

Source: Bloomberg

So is traded volume beneficial at all?

Yes, significant volumes indicate that lots of different investors are comfortable with the structure and the product. However, this is probably most useful in a standard beta product rather than an added value strategy, for example smart beta. Our view is investors should really avoid this way of benchmarking ETFs and focus on the liquidity pass-through benefits of the product and this will significantly broaden their investment horizons and opportunities.

The WisdomTree Europe Capital Markets team is always available to answer any client questions and to help clients navigate their ETF trade efficiently.

Contact CapitalMarkets.eu@wisdomtree.com to learn more.

[1] AUM: Source: Bloomberg (10 Dec 2015)

[2] AUM: Source: Bloomberg

[3] 30 Day ADV: Source: Bloomberg