Vodafone looks to Virgin for four play

Opportunities for investors are opening up in telecoms, as companies look to take advantage of consumers who are increasingly bundling their home phone, TV, internet and mobile packages with the same provider in a ‘quad-play’ offering, says Mark Benbow, investment analyst in Kames Capital’s fixed income team.

Vodafone has been making a number of acquisitions of cable companies across Europe in order to benefit from the ‘quad-play’ trend and Benbow believes more deals are likely in both the UK and Germany.

Benbow explains the opportunity in more detail in the Q&A below:

What is happening?

We are seeing consumers moving to more ‘quad-play’ offerings. For a long time, we have increasingly seen consumers bundle contracts for their home phone, TV package and internet with the same provider (‘triple-play’). Now, a 4th product (mobile – ‘quad-play’) is being added to that offering. One aim for providers offering such deals is to forge longer-term relationships with customers by making it more laboursome for them to switch providers.

What is the evidence?

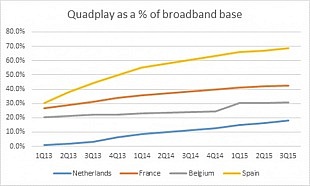

The below chart shows the % of broadband customers that take mobile with the same provider, a trend which has been rising very quickly over the last 2/3 years.

Why is that a problem for Vodafone?

BT in the UK has recently launched a mobile offering with EE and Deutsche Telekom in Germany launched a converged product 12 months ago, meaning both countries are just starting on the chart above. Two of Vodafone’s biggest markets are the UK and Germany. For large parts of the consumer set Vodafone does not own its own fixed line network and in order to try and compete with the quadplay trend they have been trying to buy cable companies.

What has happened so far?

Vodafone has bought a number of cable companies to address this issue (Kabel Deutschland in Germany in 2013 and ONO in Spain in 2014). In February 2016, they announced a joint venture with the main cable company in the Netherlands (Ziggo).

What does this mean for future deals?

Given Vodafone remains structurally challenged in both the UK and in some parts of Germany, we believe more deals are likely. The two most obvious targets are Virgin Media in the UK and Unitymedia in Germany (both coincidentally are owned by Liberty Global who own 50% of the Netherlands joint venture).

How would a potential deal be structured?

At this point it’s unclear as to whether Vodafone would buy the assets outright, go down a joint venture route or indeed do some type of asset swap with Liberty Global.

How are we positioned?

There is downside risk to playing a deal from the Vodafone side should they decide to leverage up their balance sheet to fund a deal. As a result, we are owners of both Virgin Media bonds and Unitymedia bonds which both have strong fundamentals but could be dissolved into a higher rated Vodafone structure giving upside potential.