Latest Hometrack UK Cities House Price Index reveals house price growth running at 10.4% up from 6.6% twelve months ago

– Year on year city level growth ranges from 15.8% in Cambridge to -6.1% in Aberdeen

– A referendum vote to leave the EU likely to impact transaction volumes more than house prices

– Hometrack estimates UK Cities could see a 5%-10% reduction in transactions on a vote to leave

– A ‘Brexit’ would hit London market activity hardest

– A vote to remain would most benefit regional cities such as Manchester, Leeds and Birmingham

The latest Hometrack UK Cities House Price Index reveals that city level house price growth is running at 10.4% compared to 6.6% twelve months ago when growth slowed in the face of uncertainty over the 2015 General Election.

The recent surge in transactions ahead of the April 2016 stamp duty change resulted in most cities registering a spike in monthly house price growth with the annual rate of growth higher than 2015 in 15 of the UK’s 20 leading cities. Cambridge continues to lead the way recording a 15.8% increase while Aberdeen is the only UK city bucking the upward trend posting a fall of -6.1%.

City level house price inflation – Hometrack 20 Cities House Price Index:

| City | Average price | % yoy current | % yoy 12 mths ago |

| Cambridge | £411,900 | 15.8% | 8.6% |

| London | £466,000 | 14.4% | 9.3% |

| Bristol | £247,500 | 13.8% | 8.1% |

| Portsmouth | £210,400 | 9.0% | 7.0% |

| Southampton | £208,600 | 9.0% | 5.9% |

| Bournemouth | £259,700 | 8.6% | 5.5% |

| Birmingham | £140,200 | 8.3% | 3.4% |

| Manchester | £142,600 | 7.8% | 4.3% |

| Leicester | £149,200 | 7.4% | 4.2% |

| Oxford | £393,100 | 7.1% | 11.8% |

| Leeds | £147,600 | 6.7% | 4.5% |

| Cardiff | £186,100 | 6.3% | 5.4% |

| Nottingham | £133,200 | 5.9% | 4.3% |

| Liverpool | £109,100 | 5.5% | 1.0% |

| Sheffield | £126,100 | 4.7% | 3.6% |

| Belfast | £122,600 | 4.1% | 6.9% |

| Edinburgh | £196,500 | 4.0% | 4.8% |

| Glasgow | £109,100 | 3.5% | 4.5% |

| Newcastle | £123,400 | 2.5% | 2.2% |

| Aberdeen | £183,400 | -6.1% | 3.3% |

| 20 city index | £232,800 | 10.4% | 6.6% |

| UK | £197,100 | 8.3% | 5.3% |

Source: Hometrack UK Cities House Price Index

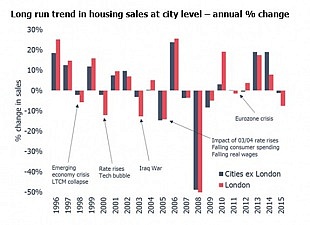

The impact of the forthcoming EU referendum on the economy and the housing market is an area of heated debate. The latest UK cities house price index report reflects on 20 years of house price growth and housing turnover to reveal how external factors can impact housing market activity. What this analysis shows is that uncertainty amongst consumers over the outlook for the economy and personal finances tend to have a greater impact on the volume of housing transactions rather than house prices.

This historic analysis implies that were the UK to vote for ‘Brexit’ then there could be a 5% to 10% reduction in housing transactions that would particularly impact London. A vote to remain would deliver a boost to market confidence and deliver the greatest benefit to large regional cities such as Manchester, Leeds and Birmingham where housing demand is growing and current rates of house price growth are likely to be sustained.

The analysis highlights how transactions have varied over time and some of the external influences. While many associate the decade before 2007 as a period of strong house price growth, the reality is that sales volumes fell on four occasions in London by as much as 15% highlighting how London is more prone to the impact of external factors, especially after periods of rapid price appreciation – from the crisis in emerging economies and collapse of the Long Term Capital Management hedge fund in 1998 to the bursting of the dot-com bubble in 2000 and the Iraq war in 2003. The 15% drop in sales seen in 2005 was registered across the country, driven largely by domestic factors and rising interest rates in 2003/04. In contrast, the impact of the 2011/12 Eurozone crisis on turnover was more muted as the market was just starting to recover after the 2008 financial crisis.

Source: Hometrack

Richard Donnell, Insight Director at Hometrack says:

“The economic impacts of a vote to leave will dictate the impact in the housing market. Our analysis of how the market has responded to external factors over the last 20 year suggests that a vote to leave on 23 June could result in a 5% to 10% fall in housing turnover with London bearing the brunt. After a period of strong house price inflation over the last 5 years, the London market faces greater headwinds irrespective of the referendum vote. Turnover fell 7% last year on the back of affordability constraints and weaker overseas demand. Tax changes for investors will reduce demand and we expect price growth to slow in the near future even if sterling were to weaken and improve the relative value of central London property.”

Donnell continues:

“A vote to remain will have the greatest upside for house prices and transactions in regional cities where the recovery has been more short-lived and affordability less stretched than in southern cities. The boost to confidence from a vote to remain, coupled with low mortgage rates would most likely benefit cities such as Manchester, Leeds and Birmingham as housing demand and price growth seems set to sustain itself.”