Families turning to loans and credit cards to fund the 'perfect Christmas' as pressure mounts from family, friends and TV advertising

– Nearly six in ten households say they make sacrifices to buy Christmas presents, which includes taking out credit to fund purchases

– Over half of families say they feel under pressure to have the perfect Christmas

– Families also sacrificing paying household bills or delaying rent or mortgage payments in order to purchase gifts

– Average UK household will take until April 2018 to pay off Christmas debts

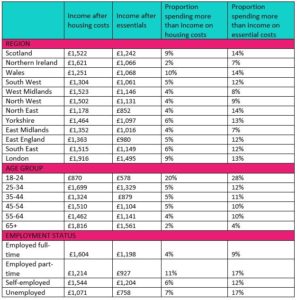

– Median UK household has £1,126 left each month after paying for essentials

The latest Disposable Income Index (DII) published today by ISA provider Scottish Friendly reveals that many British families feel pressure to create the perfect Christmas and are taking out loans or spending more on credit cards in order to buy gifts. Nearly six in ten (56%) households say they make sacrifices to buy Christmas presents and of those with children 31% are relying on credit to fund their purchases.

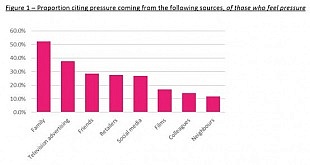

The pressure to have a perfect Christmas and the impact this has on Brits spending habits comes from a range of sources (see fig.1), including other family members (52%), TV advertising (38%), friends (29%), retailers (28%) and social media (27%).

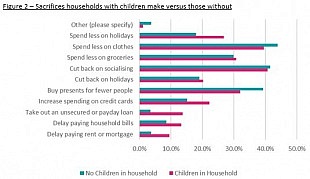

With this perceived pressure affecting many Brits, more than three quarters (76%) of households with children say they make some form of financial sacrifice in order to buy Christmas presents, compared to just 45% of those without (see fig.2). Most worryingly, just over one in eight (13%) families who are making sacrifices say they delay paying household bills to buy presents, while one in ten (10%) postpone their rent or mortgage payments.

The quarterly report, compiled in conjunction with leading think-tank the Social Market Foundation, shows that the median UK household has £1,126 left each month after paying for absolute essentials of housing, energy, water and a broader basket of goods including groceries, transport, childcare and broadband internet. These goods are required to play a full role in modern society. Money left at the end of the month is available for other key items like clothing, furniture and savings as well as luxuries like holidays.

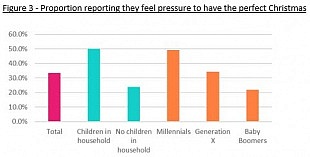

Unsurprisingly, households with children are the group most likely to feel under pressure to have the perfect Christmas. Half of families (50%) admit to feeling this way to compared to less than a quarter (24%) of households without children (see fig.3), which may explain why the former are more likely to be making some form of financial sacrifice.

A similar issue can be found among millennials, 49% say they feel pressured to have a perfect Christmas and more than three quarters (78%) report making sacrifices to buy presents. One in five (20%) say are they are likely to increase spending on their credit card as a result while 14% take out an unsecured or payday loan.

On average Brits anticipate spending £342 on Christmas presents this year with £303 going on credit cards. Paying back the money they borrow for Christmas is also expected to take some time with the average household saying it takes four and a half months. As a result many households are unlikely to be able to clear their Christmas debts until April 23 2018.

Calum Bennie, savings expert at Scottish Friendly, says: “

“Christmas is a time for giving and it seems that spirit is alive and well in Britain in 2017. However, our report shows that the season of goodwill is putting significant social and financial pressures on us. Family, friends, TV advertising, retailers and social media are all combining to push us even harder in pursuit of a ‘perfect’ Christmas and in many cases that pressure is having a detrimental financial impact.”

Bennie continues:

“Unsurprisingly many people want to forget financial problems at this time of year but splurging over Christmas is leaving many households with a hangover they can’t shift for several months. By all means enjoy the holidays, but don’t become too reckless in the face of peer pressure or idealised visions of what Christmas should be from TV advertising or retailers. With a bit of planning and restraint you will find you won’t end up out of pocket and in debt and will still be able to have an enjoyable Christmas.”

Bennie concludes:

“The message from economic experts in recent weeks has been that the UK is on course for the longest fall in living standards for more than 60 years as real disposable incomes continue to fall. Households should take heed of this warning and make sure they have contingencies in place to cope with an increase in spending and to ensure they are not left feeling the pinch far into 2018.”

Notes to Editors

Data appendix

![]()

Contacts:

Chris Tuite, Associate Director, MRM

020 3326 9925

07471 350 810

Tom Briffitt, Consultant, MRM

020 3326 9902

About the Disposable Income Index

This quarterly report is compiled along with leading think-tank the Social Market Foundation and provides a unique insight into the financial health of the UK population. It analyses consumer sentiment, current economic data and trends to chart UK consumers’ saving and spending habits and the consequent impact on disposable income.

For more information visit http://www.scottishfriendly.co.uk/my-insights

Methodology

The Scottish Friendly Disposable Income Index is based on a quarterly online nationally-representative survey of 2,000 UK adults, carried out by 3Gem. Survey data was collected between October 26th and November 3rd 2017.

Within the survey, respondents are asked for details of four components of income:

- Post-tax income from work

- Income from benefits or tax credits

- Income from investments

- Income from private or occupational pensions

In each case, respondents are asked for monthly data as this is basis on which most income will be paid. Where reasonable, they are prompted to think of sources of this information, for example pay slips.

These data are aggregated to provide an accurate picture of income at a household level. Asking questions about specific components of income allows us to build a more complete picture.

Respondents are then asked about essential bills, including:

- Housing costs: rent or mortgage costs

- Council tax

- Water

- Gas, electricity, solid fuel (including a dual fuel option)

- Buildings & contents insurance

- Ground rent and service charges

We ask both how often bills are paid, and how much they are, allowing respondents to provide information in the form that is most familiar to them and removing as far as possible the need for bills to be estimated. The data is then cleaned to provide a monthly estimate of total essential costs for each household.

We also consider a set of costs which are not absolutely essential for human life, but are nonetheless necessary to play a full and active role in modern society, including:

- Groceries

- Broadband or other internet services, telephone calls and television subscriptions

- Mobile phone bills

- Childcare

- Transport (petrol, public transport fares)

These costs are subtracted from reported income at each household, to create an estimate of disposable and discretionary income – here defined as income after housing costs, and after a basket of essentials needed to participate fully in modern society are purchased.

Data is not equivalised for household size, but we do check median household size across sub-groups to ensure any significant differences are flagged to the reader.

Scottish Friendly

Scottish Friendly is a leading UK mutual life and investments organisation. It provides investors and their families with a wide range of investment solutions and provides administration of life and investment products to other financial organisations.

www.scottishfriendly.co.uk

@ScotFriendly

Scottish Friendly, Scottish Friendly House, 16 Blythswood Square, Glasgow, G2 4HJ

Scottish Friendly Assurance Society Limited. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Scottish Friendly Asset Managers Limited. Authorised and regulated by the Financial Conduct Authority.

Social Market Foundation

The Social Market Foundation is a non-partisan think tank. It believes that fair markets, complemented by open public services, increase prosperity and help people to live well.

www.smf.co.uk

@SMFthinktank