KUW8 Benefits as MSCI Upgrades Kuwait to Emerging Markets

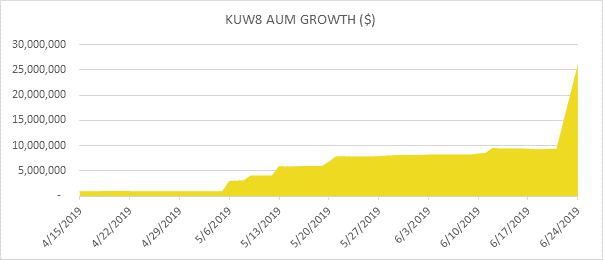

– Only Pure-Play Kuwait ETF in the world, KUW8, grows 2,488% since April launch

– Kuwaiti economy benefiting from index reclassifications, economic diversification programme & capital markets improvements

PRESS RELEASE

London, 26 June, 2019

HANetf, Europe’s first independent ‘white label’ UCITS ETF issuer has announced spiking asset growth in KUW8 around the MSCI upgrade[i] of Kuwait to Emerging Market status.

The decision by MSCI follows on the heels of similar reclassifications by index leaders FTSE Russell and S&P, that upgraded Kuwait in 2018. Kuwait will be added to the MSCI Emerging Index in the May 2020 rebalance with an initial weight of ~0.5%, representing ~$2.8 billion of market capitalisation[ii]

The change in classification reflects improvements in Kuwaiti capital markets infrastructure, operations and foreign investor accessibility which have been implemented by the Kuwaiti Stock Exchange and local regulators. Kuwait is currently in the middle of an extensive long-term economic diversification programme, “Vision 2035”, designed to encourage foreign investment and reduce dependency on oil revenues.

As investor interest in Kuwait intensifies, the KMEFIC FTSE Kuwait Equity UCITS ETF (KUW8) has surged, growing 2,488% since inception on April 15th.

The ETF was launched on London Stock Exchange, Borsa Italiana and XETRA via the HANetf white-label platform in April 2019 with Kuwait & Middle East Financial Investment Company as sponsor.

To provide investors with unique local insight into the expected impact of the upgrade, HANetf and KMEFIC are hosting a webinar on 4th July at 11 BST.

Jason Griffin, Director of Capital Markets & Business Development at HANetf, said:

“The decision by MSCI to reclassify Kuwait to Emerging Market status will catalyse significant trading activity as index managers rebalance Emerging and Frontier portfolios and active managers seek alpha-generation opportunities. Accessing Kuwaiti securities directly is not always straight forwards and investors can take advantage of the KMEFIC FTSE Kuwait Equity UCITS ETF (KUW8) to obtain a diverse and transparent basket of Kuwaiti securities in a UCITS structure, supported by an extensive liquidity ecosystem. The rapid growth of assets in KUW8 highlights the ability of the ETF structure to absorb significant assets and the importance of looking beyond screen volumes and understand the implied liquidity of an ETF.”

Tracking the FTSE Kuwait All-Cap 15% Capped Index, the KMEFIC FTSE Kuwait Equity UCITS ETF (KUW8) enables investors to gain exposure to a basket of Kuwaiti companies with a combined market capitalisation of ~$US25.9 billion.

| EXCHANGE | BB CODE | RIC | ISIN | SEDOL | CCY | INCOME |

| London Stock Exchange | KUW8 | KUW8.L | IE00BGPBVS44 | BGY9KV5 | USD | Acc |

| London Stock Exchange | KUWP | KUWP.L | IE00BGPBVS44 | BGSXQZ9 | GBP | Acc |

| Borsa Italiana | KUW8 | KUW8.MI | IE00BGPBVS44 | BGSGKH8 | EUR | Acc |

| XETRA | KUW8 | KUW8.GY | DE000A2PO3R9 | BJ9ZLG1 | EUR | Acc |

[i] www.msci.com/market-classification

[ii] https://www.msci.com/documents/10199/238444/RESULTS_OF_MSCI_2019_ANNUAL_MARKET_CLASSIFICATION_REVIEW.pdf/f134c97c-73da-71c7-4b3c-d1f637c3eaee