Normal? It’s time to redefine it

Anyone looking for a return to ‘normal’ won’t find it any time soon. Let’s think about what is to come with positive intent.

While the consensus is patchy at the moment, most acknowledge that the world we are waking up to now will most likely never go back precisely to the way it was before.

Social distancing and movement restrictions look here to stay. Although at the time of writing the whisperings are that many businesses are looking to get back into the swing of things, the way this will function appears evidently to be changing.

So how do we accept and adjust to the new normal? For many of us moving to working from home en masse was like ripping off a plaster – it hurt. But for those of us fortunate enough to work in industries such as financial services where many jobs, although often a trial to get going, can be done remotely, we have adapted.

But now the realisation that there will be no return to day dot per se. Companies will be returning partial workforces to offices. Some may even question if they are able to function at more or less normal, whether they really need an office at all, or at least smaller premises.

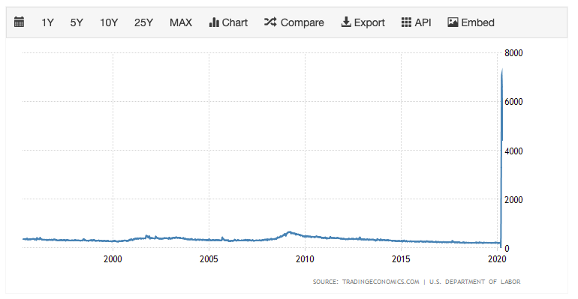

And it’s not just working patterns that have been altered. Many of the events and data that we as an industry rely on have been skewed unfathomably by this crisis. I note in particular the example of the weekly US jobless figures which so surprised us all. So extreme was the increase in unemployed the figure looked like a statistical aberration.

Fortunately however the reporting of such figures hasn’t faltered in timing. We did notice the ONS has started reporting its number much earlier in the day, but this has indeed proved to be useful for those quick off the mark in reacting.

As for what is coming in May, it is again somewhat caveated as changing scenarios unfold. We expect the government to review the lockdown on or around 7 May, with a fresh interest rate decision from the Bank of England on the same day.

In the middle of the month on 13 May we have the first set of ONS UK GDP figures released for Q1. While this may not capture the worst of the crisis in economic terms, it will perhaps shed some light on what began to take hold as fear spread and consumers stayed home.

On 19 May the OECD publishes its economic outlook. This report from the respected organisation is likely to make for tough reading for all, and will most likely confirm some of the worst assumptions made by the OBR in April for the future of our economy.

Finally, the US publishes its Q1 GDP stats on 28 May, a date which will round off a month in which we should start getting some concrete information on how bad it really is out there.

Meanwhile, MRM has continued its diligent work and will go on doing so remote or otherwise for now. April highlights included several Zoom-based pub quizzes, with some fiendish music rounds to boot, and the appointment of myself and fellow News & Content consultant Paul Thomas as co-editors of online money blog Mouthy Money, to go alongside our roles for MRM.

All the best from the team here. Hoping your lockdowns are going well and a smooth transition back to normal beckons, whatever that may soon be.