9,000 jobs gone and 200 branches closed? That’s just the start.

Lloyds Banking Group is closing 200 branches in a bid to cut £1 billion in costs by 2017 and prepare for a digital revolution in financial services. Lloyds is not the first bank to cite a “change in customer needs” as reasoning behind branch closures or a reduction of staff, and it certainly won’t be the last. But the truth of the matter is this;

The customers’ needs have not changed.

All that has changed is the ability for the financial services industry to match its offering more closely to the customer’s expectations.

Waiting in line for 40 minutes on a lunch break to handover a cheque which won’t clear for five days was never the “customer’s need”. It was a reality forced on the consumer by a system unable to move faster.

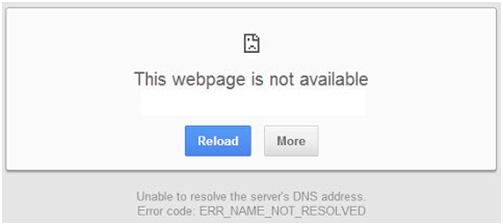

Advances in technology are bringing new and innovative ways of providing services to the people in almost every industry on the planet. The internet is literally killing entire businesses and consumers are happy about it because they are still getting exactly what they need in exactly the way they’ve always thought they should; quickly.

Ask someone on the customer service desk at any bank how often a customer at their wit’s end exclaims something like “I don’t understand why this takes so long!?!”. This is the call-to-action of the innovators who are inventing the tools that the internet needs to kill unnecessarily time intensive processes, and there are few industries as plagued by these as banking.

“Tip: Take the stodgiest, oldest, slowest moving industry you can find. And build amazing software for it.”

Aaron Levie, CEO of Box

It used to take so long to transfer money from one account to another that you didn’t bother. You’d just take the cash out of an ATM and hand it to whomever it was you were trying to pay. Now the Faster Payments Scheme, which benefits from VocaLink’s technology makes it possible to move money in seconds. Combined with a revolution in data speeds and the advancement in handheld technology, we can now send money immediately from anywhere, to anywhere and it’s easy.

Ten years ago, carnage at a sale looked like this:

Now it looks like this:

Slowly, the things that drove you into bank branches are being replaced by better, faster, more available net-based alternatives. Transferring money, checking your balance, topping up your ISA – it’s all online. The RDR (Retail Distribution Review) made it difficult for banks to give financial advice to investors while remaining profitable so they scaled back, massively. Once again, when the industry struggled to serve all clients, innovation delivered by moving advice online via services such as Wealth Horizon, the first web based service able to offer real regulated advice.

These innovators are serving knock-out punches to establishments hundreds of years their senior, because they are building businesses to the rhythm of the disgruntled customer.

Customers who can’t understand why they can stream The Wolf of Wall Street to their phone, on a train, but have to travel half way across town to discuss finances with their very own (hopefully much less criminal) Jordan Belfort.

In a world where we can build houses quicker than we can approve mortgages, the next decade belongs to the businesses putting the consumer first and doing it faster/better.