The “Buffett Factor” Revisited

One of the most popular themes in our blog posts this year has been that of small caps. Here, we look at how our dividend index methodology connects with the way Warren Buffett looks at potential acquisitions, key aspects being:

Berkshire Hathaway Inc. Acquisition Criteria[1]

• Demonstrated consistent earnings power

• Businesses earning good return on equity (ROE) while employing little or no debt

The key phrase is “businesses earning good returns on equity while employing little or no debt.” However, the quality discussion within equity investing has a long history, and Warren Buffett certainly isn’t the only one to mention it.

Benjamin Graham’s Quality Criteria

One of Warren Buffett’s teachers, Benjamin Graham, who is known as one of the fathers of value investing, also had a rigorous focus on quality traits. Many focus on Graham’s criteria for finding inexpensive companies, but he was at least equally focused on attributes of quality, if not more so.

Benjamin Graham’s Attributes of Quality[2]

• “Adequate” enterprise size, as insulation against the “vicissitudes” of the economy

• Strong financial condition, measured by current ratios that exceed 2 and net current assets that exceed long-term debt.

• Earnings stability, measured by 10 consecutive years of positive earnings

• A dividend record of uninterrupted payments for at least 20 years

• Earnings-per-share growth of at least one-third over the last 10 years

Fama-French Operating Profitability Factor

Research done by Kenneth French and Eugene Fama arrives at a similar place. In their research piece “A Five-Factor Asset Pricing Model” from September 2014, they cite operating profitability, defined as annual revenues minus cost of goods sold, interest expense and selling, general and administrative (SG&A) expenses, all divided by book value of equity. Note, this is similar to Buffett’s criteria above: a company earning a good return (profits) on its equity (book value)—in other words, a high ROE.

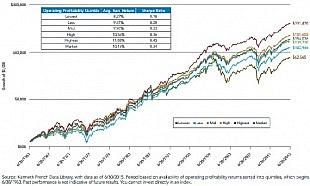

Arranging the U.S. market into quintiles based on operating profitability further emphasizes that high-quality stocks have won over longer holding periods.

The Spectrum of Operating Profitability Quintiles from June 30, 1963, to June 30, 2015

- Top Two Quintiles Outperformed the Market:We saw the top two quintiles outperform the market on two fronts—average annual returns andSharpe ratio. In other words, this outperformance was not achieved with a significant increase in risk.

Grantham on Why Quality May Outperform over Long Periods

One of the long-standing investment practitioners of quality investing has been Jeremy Grantham’s firm, GMO. In a paper written in 2004[3], GMO wrote of quality firms:

“… even though many of these corporations tend to generate high profits year after year, they are systematically underpriced because they lack volatility. Instead of overpaying for these companies, as finance theory would suggest—given their low risk profile—shareholders in fact do just the opposite: they underpay. The result is that investors in high-quality companies get to forge ahead with 15+% returns year after year without overpaying. Of course, in any given year, low-quality stocks can and do stage rallies and high-quality stocks can underperform. But the high-quality stocks have always won over longer holding periods. No matter what metric is used to identify quality stocks—leverage, profitability, earnings volatility or beta—high-quality stocks have beaten out low-quality stocks.”

In other words, the desire to try to find that “next big thing” tends to exert so much power over the investment psyche that focusing on quality companies has, at least historically, been one avenue through which to achieve outperformance.

At WisdomTree, we also believe that focusing on quality factors through rules-based processes can be a compelling investment strategy over the long term. Our SmallCap Dividend strategies are a prime example of this, combining a quality tilt, through the cash dividends weighting methodology, with the natural growth element of small cap stocks. These fundamental factors have contributed to the outperformance of our SmallCap Dividend strategies relative to market-cap weighted peers (a recap on the performance of our SmallCap Dividend Indices can be found here).

Investors sharing this sentiment may consider the following UCITS ETF:

- WisdomTree Europe SmallCap Dividend UCITS ETF (DFE)

- WisdomTree US SmallCap Dividend UCITS ETF (DESE)

- WisdomTree Emerging Markets SmallCap Dividend UCITS ETF (DGSE)

All data is sourced from WisdomTree Europe and Bloomberg, unless otherwise stated.

Disclaimer

WisdomTree Europe Ltd is an appointed representative of Mirabella Financial Services LLP which is authorised and regulated by the Financial Conduct Authority.

The value of an investment in ETPs may go down as well as up and past performance is not a reliable indicator of future performance. An investment in ETPs is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

ETPs offering daily leveraged or daily short exposures (“Leveraged ETPs”) are products which feature specific risks that prospective investors should understand before investing in them. Higher volatility of the underlying indices and holding periods longer than a day may have an adverse impact on the performance of Leveraged ETPs. As such, Leveraged ETPs are intended for financially sophisticated investors who wish to take a short term view on the underlying indices. As a consequence, WisdomTree Europe Ltd is not promoting or marketing BOOST ETPs to Retail Clients. Investors should refer to the section entitled “Risk Factors” and “Economic Overview of the ETP Securities” in the Prospectus for further details of these and other risks associated with an investment in Leveraged ETPs and consult their financial advisors as needed. Within the United Kingdom, this document is only made available to professional clients and eligible counterparties as defined by the FCA. Under no circumstances should this document be forwarded to anyone in the United Kingdom who is not a professional client or eligible counterparty as defined by the FCA. This marketing information is intended for professional clients & sophisticated investors (as defined in the glossary of the FCA Handbook) only.

This marketing information is derived from information generally available to the public from sources believed to be reliable although WisdomTree Europe Ltd does not warrant the accuracy or completeness of such information. All registered trademarks referred to herein have been licensed for use. None of the products discussed above are sponsored, endorsed, sold or promoted by any registered trademark owner and such owners make no representation or warranty regarding the advisability on dealing in any of the ETPs.

[1] Source: Berkshire Hathaway annual letter to shareholders from Warren E. Buffett, 2/28/15.

[2] Source: Benjamin Graham, “The Intelligent Investor” (4th revised edition), Harper & Row, 1973.

[3] “The Case for Quality—The Danger of Junk,” GMO white paper, 3/04.