Early bird investors do catch the worm, Willis Owen research reveals

Consumers who put their full ISA allowance in on the first day of the new tax year have outperformed those people who wait or invest regularly, new research from Willis Owen has shown.

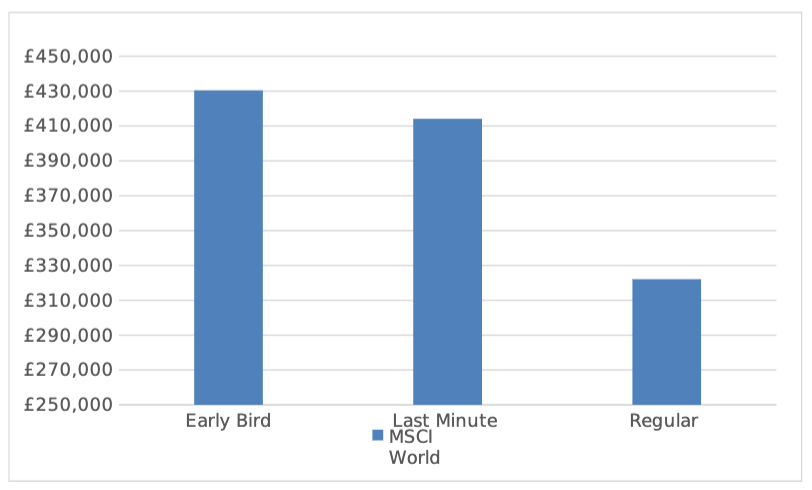

People who invested their allowance in global equity markets since ISAs were launched on 6th April 1999 earned significantly more than those who left it until the last minute, and those who saved regularly each month, figures show.

By investing the full ISA allowance into the MSCI World (excluding charges) at the start of each financial year over the past 21 years, an investor would have seen their ISA value grow to £430,480 – a huge £16,327 more than if they had waited until the end of the tax year.

Adrian Lowcock, Head of Personal Investing, Willis Owen:

“It is time in the market that matters the most, not timing it. Given that stock markets generally rise over the longer term, there is a significant advantage to investing at the start of the tax year rather than waiting until the end. With the increase of the ISA allowance over the past few years, we would expect this gap to continue to widen over time.

“Using your ISA early also means that your investments grow tax-free for longer. In particular, the income from your investments inside an ISA will not be subject to income tax.

“The benefits of using an ISA early on are more than just financial. By investing at the beginning of the tax year, people can avoid spending the money on something else. They can also avoid the stress of doing it last-minute, so when the end of the tax year comes, they can relax whilst others are panicking.”