House prices pick up in London over the second quarter as market shows early signs of stabilisation

- London house prices up 1.8% in three months to June as sellers become more realistic over pricing

- Level of discounting from asking price in London narrows for first time in 2 year

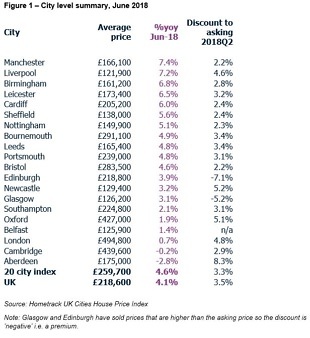

- UK city house price growth +4.6% – from +7.4% in Manchester to -2.8% in Aberdeen

- Manchester has lowest discounting from asking prices at 2.2%

London City house price growth has picked up over the last quarter as the capital’s housing market starts to stabilise, according to the latest Hometrack UK Cities House Price Index. In the three months to June, house prices rose by 1.8%, having fallen by 1% over the previous 6 months.

After two years of weak demand and falling sales, there are signs that London’s housing market is beginning to steady, although the annual rate of growth remains low at +0.7%. The recent trend is supported by the fact that 61% of postcodes in London are currently registering month-on-month price rises according to Hometrack’s most granular indices.

This modest improvement in market conditions reflects greater realism on the part of sellers in the wake of a two-year re-pricing process. The discounts sellers must give buyers to achieve a sale has started to narrow across London, reversing a 2 year upward trend where the discount grew from 1% in 2016Q2 to 5% in 2018Q1. It has fallen back to 4.8% (see Figure 2 below).

London is in a group of six cities where house prices are failing to keep pace with the rate of goods inflation (CPI) and where house prices are falling in real terms – Southampton (2.1%), Oxford (1.9%), Belfast (1.4%), London (0.7%), Cambridge (-0.2%) and Aberdeen (-2.8%).

House price growth is strongest in cities in the Midlands and North West of England. Manchester is registering the highest annual growth rate (7.4%), followed by Liverpool (7.2%), Birmingham (6.8%) and Leicester (6.5%).

The level of discounting from the asking price to achieve a sale is lowest in Manchester (2.2%) where market conditions have remained strong for the last 2 years. Discounts have fallen in Liverpool, where prices are rising off a low base, but remain above average at 4.8%.

Richard Donnell, Insight Director at Hometrack, says: “After 2 years of falling sales volumes and rising discounts to achieve a sale there are some signs of life returning to the London housing market. Discounts are finally starting to narrow as sellers become more realistic over pricing.”

Donnell adds: “While prices in London have picked up over the last quarter, we expect the annual rate of growth to remain weak for the foreseeable future. The positive news is that greater realism on the past of sellers will support transactions, which have fallen by 20% since 2014.”

Donnell adds: “The UK market is operating at two-speeds at the moment, with growth in regional cities in the Midlands and North West far outstripping those in the South. However, affordability pressures in the South East in particular are having a slowing effect on house prices as borrowers are priced out of the market.”