Is 2020 the year for investors to ‘Sell in May’?

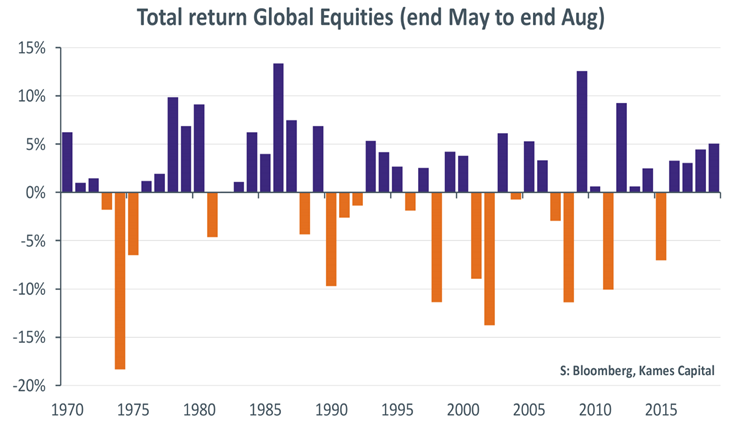

The old adage of ‘sell in May and go away, don’t come back till St. Leger Day’, or selling global equities in May and returning in mid-September, has proved to be the correct strategy for investors in only 17 out of the past 50 years and only twice since the Global Financial Crisis. In light of the Covid-19 pandemic, Stephen Jones, Global CIO Multi-Asset & Solutions and Equities at Aegon Asset Management asks, might 2020 be the third?

Jones says: “The adage of ‘sell in May’ dates from the time that UK stockbrokers would typically leave their desks to enjoy the summer ‘season’, ending with the St. Leger flat horse race at Doncaster race course in mid-September. With May now upon us, it’s that time of year again for investors to wonder whether it’s worth sending their investments on a ‘summer holiday’ too.

“Global equity markets have risen powerfully, +26% since their mid-March low, buoyed by the prospect of economic revival and fuelled by unprecedented monetary and fiscal support. Impressive as this has been, markets are still 16% below levels reached in February. It is perhaps then not too challenging to believe that while Covid-19 will pass, the policy support will endure and if so, this rally could easily continue – after all, equity investors love to dream.

“Unfortunately, the market has detached from the real economy. While re-opening is underway, as with the virus itself, the process of economic recovery is likely to prove long and challenging. Those businesses that survive the shutdown, and not all will, will find that the cost of doing business will have risen significantly and many will find that their fixed overheads are too high a hurdle to jump. As a result, it is likely that aggregate corporate earnings will take several years to recover. This leaves the valuation of equities stretched with little to cushion disappointment. Looking into the summer months, it is inevitable that challenges will emerge, and recent years have seen each successive shakeout happen faster and sharper each time.

“We may not be able to holiday as we would have liked this summer, but that doesn’t mean that you can’t offer your savings a much-needed time out.”