Oil supply glut not yet over: Learn how to position around oil’s latest slump

The resurgence of US shale is undermining oil market fundamentals once again. Despite OPEC’s best efforts to pump up oil prices, recent surges in US stockpiles to record highs point to a global oil supply glut that is showing no signs of improvement. Unless market dynamics change, the short-term outlook for oil prices is likely to be bearish and volatile. This may entice tactical investors to take up positions using short and leveraged ETPs, whilst strategic investors may consider this an attractive entry point to boost their long-term oil exposure.

Market fundamentals continue to look vulnerable

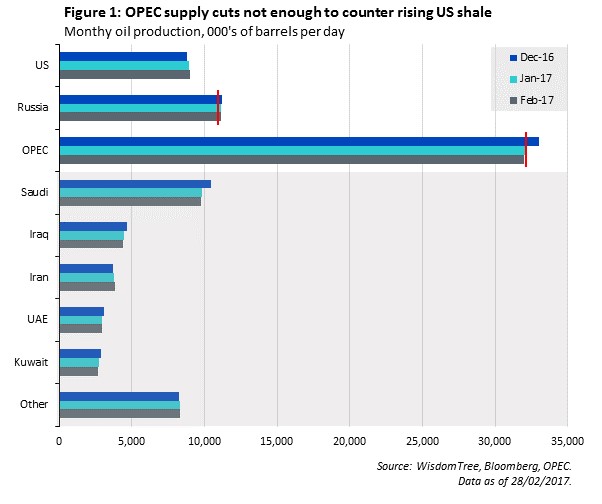

Monthly production figures over the past three months reveal that OPEC successfully cut production below the agreed target of 32.5m barrels a day, driven disproportionately by cuts from Saudi Arabia, Iraq and UAE, as shown in Figure 1. Though initially successful in driving up oil prices into the mid-US$50s, the effectiveness of OPEC supply cutbacks has been significantly blunted by US shale producers ramping up production on profitable wells, adding over 250,000 barrels a day to total US oil output.

In fact, US rig counts have increased 30% since November and there are now as many active drilling rigs as in September 2015, just prior to oil prices hitting ten year lows of $28/bbl. Even as oil prices trend sideways, the potential remains for US rig counts to rise higher still, especially on the back of continued improvements to horizontal drilling methods and ongoing industry consolidation.

Faced with increasing supply pressure, OPEC will be compelled to extend current supply agreements and/or enforce greater compliance to supply targets in order to provide support for higher oil prices. This is likely to form the main agenda at OPEC’s next meeting on 25 May 2017, and output targets for Iran and Nigeria, both of which have seen production increase over recent months, are likely to come under scrutiny. Furthermore, the slow pace of reduced output by Russia plays into the mix of balancing economic needs and boosting oil prices.

Yet, any catalyst for higher oil prices is likely to be short-term in nature only, simply because OPEC-induced supply shocks will encourage greater US shale production. This in turn will push OPEC to make deeper cuts, thereby creating a vicious cycle whereby supply remains bloated and oil prices stay depressed. With global growth still too sluggish to pick up the slack, the unabated expansion of supply sets oil prices up for further downside and increased volatility.

So how should investors be looking to position?

Though not an accurate prediction of future prices by any means, the oil futures market offers investors an indication of where prices are heading. Currently, the term structure of WTI oil futures implies limited upside with futures prices anchored in the low US$50s all the way through to 2022—a 5-10% increase against current spot prices. But whilst implied upside is limited on this premise, the opportunities for investors are not.

Tactical investors with short-term investment horizons may consider leveraging up their oil exposure using short and leveraged ETPs as a means to position around increased volatility and/or improve capital efficiency. This is especially relevant given current speculative bullish positioning by hedge funds, which, at 20% of all open contracts, remains elevated above historical standards. The unwinding of these positions will add to volatility and fuel further pressure to oil prices.

Strategic investors with longer-term investment horizons may find current prices to be an attractive entry point to increase their oil exposure, especially with prices still depressed relative to historic levels. In such instances, an unleveraged oil ETP may offer a cheap and effective means of playing the potential long-term recovery in oil prices.

Ultimately short term volatility is likely to prevail over coming months with OPEC expected to support measures to maintain oil prices above US$50/bbl without encouraging an oil spike that risks generating excess supply from shale oil producers.

Investors sharing this sentiment may consider the following ETPs:

- Boost 3X Leveraged WTI Oil ETP (3OIL)

- Boost 3X Short WTI Oil ETP (3OIS)

- Boost 2X Leveraged WTI Oil ETP (2OIL)

- Boost 2X Short WTI Oil ETP (2OIS)

- Boost WTI Oil ETC (WTID)

- Boost 1X Short WTI Oil ETP (OILZ)

- Boost 3X Leveraged Brent Oil ETP (3BRL)

- Boost 3X Short WTI Oil ETP (3BRS)

- Boost Brent Oil ETC (BRND)

YOU MIGHT ALSO BE INTERESTED IN READING…

- http://www.wisdomtree.eu/article/2403/5-things-you-need-to-know-about-investing-in-oil

- http://www.wisdomtree.eu/article/2423/five-things-to-understand-before-investing-in-short-leverage-exchange-traded-products-etps

- http://www.wisdomtree.eu/article/2412/2016-leveraged-oil-etfs-reach-record-highs-while-investors-retreat-to-gold

- http://www.wisdomtree.eu/article/2378/opec-short-term-gain-long-term-continued-pain

- http://www.wisdomtree.eu/article/2336/opec-and-russia-a-balancing-act

- http://www.wisdomtree.eu/article/2324/oil-a-new-framework

All data is sourced from WisdomTree and Bloomberg, unless otherwise stated.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, its officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

This website and its content has been provided by WisdomTree Europe Ltd which is an appointed representative of Mirabella Advisers LLP which is authorised and regulated by the Financial Conduct Authority. Please click here for our full disclaimer.

View our Conflicts of Interest Policy and Inventory here.