Shale and Sheikhs’ war drives Brent/WTI spread wider

How short and leveraged ETPs can be used to trade oil price spreads

OPEC supply cuts are reducing glutted oil inventories and boosting oil prices, preserving backwardation in oil futures. Tighter expected supply conditions in 2018 are likely to ensure oil prices remain strong and above-trend.

Yet not all oil prices behave in the same way. In fact, Brent has outperformed WTI since last June, driving the Brent/WTI spread to $6its widest since 2015.

The widening spread presents trading opportunities for oil investors. In this brief, we examine how short and leveraged oil ETPs can be used to efficiently trade oil price movements.

Brent’s premium over WTI

The Brent/WTI spread is one of the most widely-traded spreads within the commodity market due to unique supply and demand drivers for both Brent and WTI. The former typically refers to oil extracted from the North Sea, but is also used as a reference for oil prices across Europe, Africa and the Middle East. WTI, on the other hand, refers to oil that is produced and refined in North America. Naturally, this makes Brent more susceptible than WTI to geopolitical risk, especially in the Middle East. Historically this has been a key driver of widening Brent/WTI spreads.

The Arab Spring that started in December 2010 is a prime example of an event that can cause widening spreads. Spreads widened to over $20 per barrel in 2011, amidst concern over the impact of regional political instability on Brent oil supply and transportation. Today, ongoing tensions between Iran and Saudi Arabia continue to underpin Brent’s price premium over WTI.

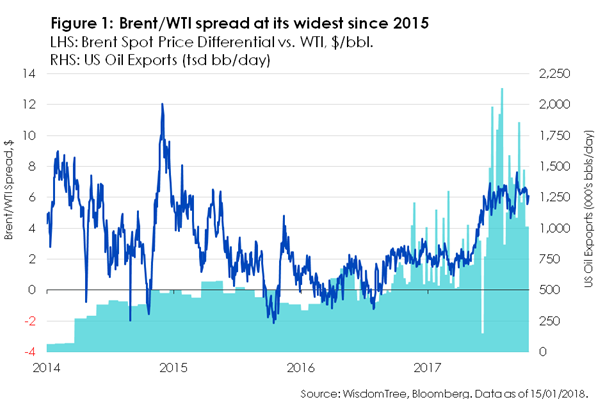

OPEC supply cuts have also been a key contributor to widening Brent/WTI spreads, with tighter supply conditions being reflected in Brent’s price. In contrast, WTI prices have faced headwinds from the shale-induced supply glut that is showing no signs of easing. Combined with the re-establishment of US oil exports in late 2015, as shown in Figure 1, WTI is now more widely available than ever before. This is likely to intensify US oil oversupply concerns and sustain wide Brent/WTI spreads.

Trading the spread

Given these differing price dynamics, the divergence in Brent and WTI oil prices presents trading opportunities for investors. A simple trading strategy example below focuses on oil price movements during Hurricane Harvey.

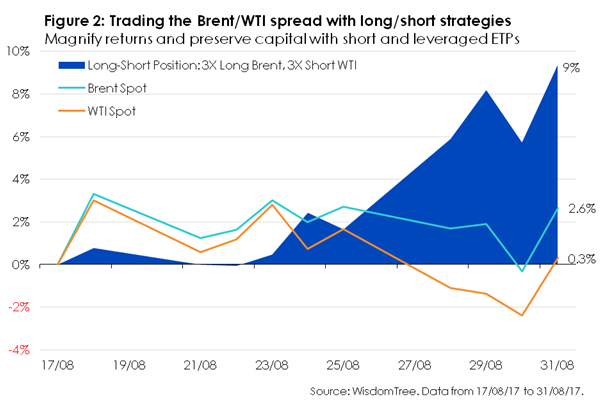

The damage to Gulf Coast oil refineries from Hurricane Harvey significantly affected US refinery capacity, temporarily weakening WTI oil demand. At the same time, Brent experienced a slight increase in demand as European refiners compensated for the shortfall in US petrol production. As a result, Brent oil prices increased almost 2.5% more than WTI prices over the course of the hurricane.

Investors could have traded the widening spread using a simple pair strategy:

going long Brent and short WTI. Investors wishing to preserve capital may consider short and leveraged ETPs, which typically require only a fraction of the capital for an unleveraged position.

Figure 2 illustrates the payoff for a long/short strategy with an equal investment in our Boost 3X Leveraged Brent Oil ETP (Ticker: 3BRL) and the Boost 3X Short WTI Oil ETP (3OIS), that is 50% of capital in 3BRL and 50% in 3OIS. During the peak of Hurricane Harvey’s intensity (17th – 31st August), the return for this long/short position would have been 9%—more than triple Brent’s spot price return.

This shows that a strategy combining opposing positions in Brent and WTI using short and leveraged ETPs can magnify spot price returns while preserving capital. Such strategies can be constructed to capitalise on either a widening or narrowing of the Brent/WTI spread.