UK equities offer ‘once-in-a-decade’ opportunity for investors – Tellworth

The largest UK stocks currently offer investors a once-in-a-decade opportunity after a slide in valuations seen only at the nadir of most cycles, Tellworth’s Seb Jory has said.

Following what has been termed one of the most hated bull markets in history, the UK has continued to lag other markets, with Brexit in particular weighing on share prices.

Jory, who joined Tellworth in 2017 from Liberum as head of data-driven strategies, said on a forward price to earnings ratio, UK equities were experiencing a one-in-ten-year event.

“The median FTSE 100 P/E is currently in the cheapest 10% of readings since 1996 – i.e. a 1-in-10-year event (Fig 1),” he said.

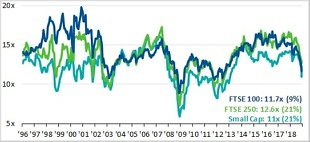

Fig 1: By median P/E the FTSE 100 is at the 9th percentile over 20+ years. SMID multiples are at 1 in 5 year lows

Source: Datastream, Tellworth Investments. NB: Priced as of close 12/12/2018, inverse earnings yield aggregation method

“Long-term investors and asset allocators should therefore be licking their lips. UK equities ostensibly present the sort of value opportunity that managers have been demanding for most of this cycle.”

While Brexit remains a clear headwind, Jory said it was being used as a “handy scapegoat” for a default underweight to the UK.

“No one wants to have to explain a big UK allocation w hen there is a chance the country could crash out of the EU without a deal,” he said.

The team at Tellworth, which was launched by fund managers Paul Marriage and John Warren and which is part of multi-boutique business BennBridge, believes there are actually several reasons to be positive on UK equities.

“The first is that if one ascribes the substantial UK discount (c. 20% vs. global equities, the highest since the global financial crisis) to Brexit, then a major mitigating factor would be a currency depreciation on ‘No Deal’ since c.70% of UK’s listed revenue is from overseas,” Jory said.

“We saw this play out right after the referendum – an eventual FTSE All Share rally. The second is that – disregarding the fundamentals – the market multiple is so low that a significant positive future return is virtually guaranteed (Fig 2).”

Fig 2: And the starting valuation is the biggest determinant your future return

Source: Datastream, Tellworth Investments. NB: ‘Biggest determinant’ because the R2 of this variable is over 50%

He added that as starting valuations are the biggest determinant of long-term returns UK equities present as close to a win/win as we get in markets.

“We think this is caused by the one-off complexity and ‘scare’ factor of Brexit, and this presents a fantastic opportunity for investors that can take this type of risk. Ignore it and there is, we think, serious opportunity cost,” he said.

“The risk-reward on UK equity indices is very attractive currently, and particularly for global businesses and large caps. They should not be ignored by default, indeed the complexities of Brexit are what has caused this opportunity.”

Stock picking also remains the key to success as there will undoubtedly be winners and losers, Jory said.

“This doesn’t mean that the UK market is attractive in its entirety. One can make an argument for Large Cap exporters (FX upside, cheap against similar companies listed elsewhere), domestics (many on sub-7x P/Es, though more exposed to Brexit) and certainly stocks in the unloved FTSE Small Cap, which remain on a healthy discount vs. the FTSE 250 (Fig 3), though care must be taken to avoid structurally declining value traps,” he said.

“However, stocks at the upper end of AIM remain expensive – the ‘bubble years’ driven by inflows and momentum chasing have only unwound by about half, we think – and the growth style still looks precariously perched, especially if economic growth worsens.”

Fig 3: However stock picking remains crucial both to avoid expensive ‘growth’ and value traps

Source: Datastream, Tellworth Investments. NB: Priced as of close 12/12/2018, inverse earnings yield aggregation method